$ 85.30 Original price was: $ 85.30.$ 3.49Current price is: $ 3.49.

OryMai

- Version: 2.31.0

- Last Update: March 6, 2024

| Compatible With | WooCommerce |

| Software Version | WordPress |

- Description

- Disclaimer

- Reviews

YITH WooCommerce EU VAT, OSS & IOSS

YITH WooCommerce EU VAT, OSS & IOSS – A tool to manage sales in the EU: charge the correct VAT for your B2C transactions, allow VAT exemption for orders made by B2B customers and enable the OSS procedure.

YITH WooCommerce EU VAT, OSS & IOSS benefit from it:

- Geolocate customers and charge the correct VAT automatically for orders made from B2C European customers;

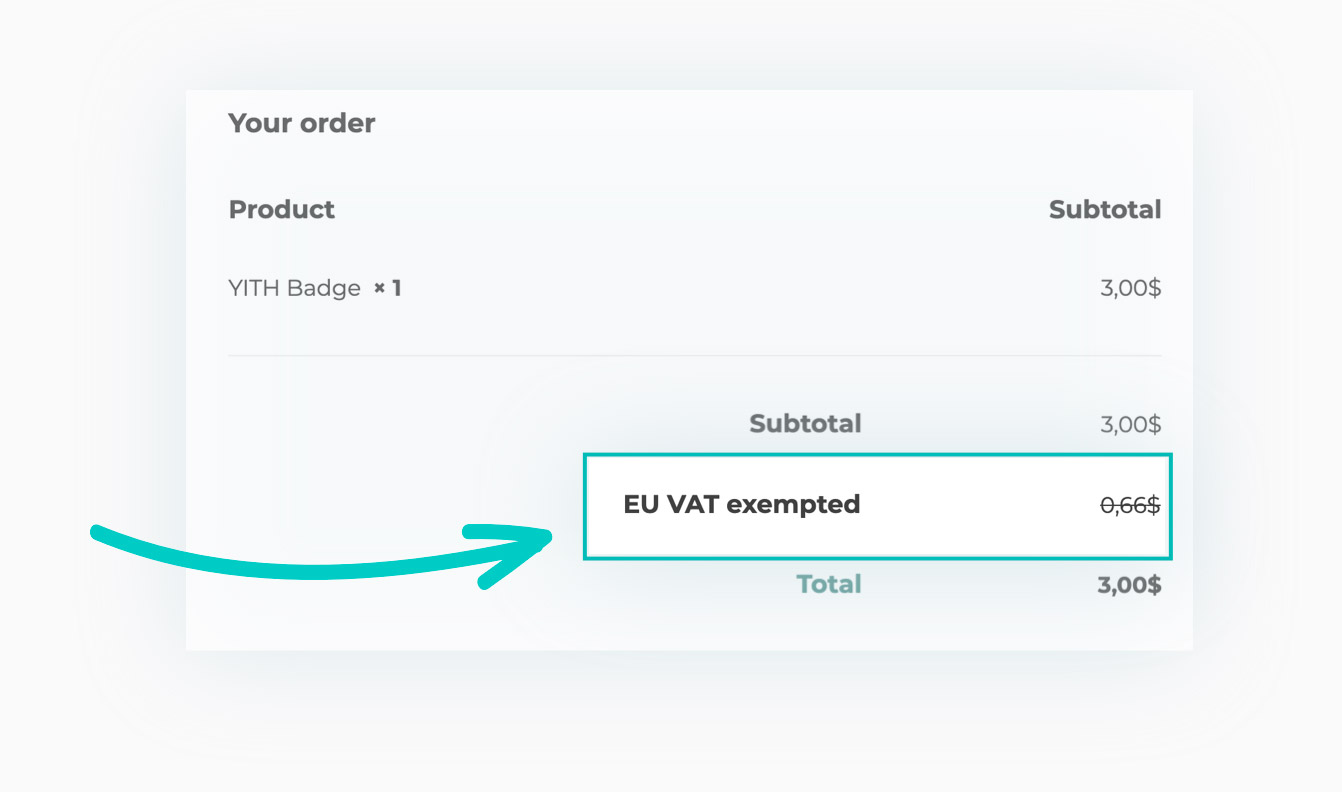

- Show a VAT field on the checkout page to collect and validate a customer’s EU VAT number. In this way, the business will be exempt from VAT at your store;

- Enable the new One-Stop-Shop (OSS) regime, required to all online retailers that manage EU sales from 1 July 2021

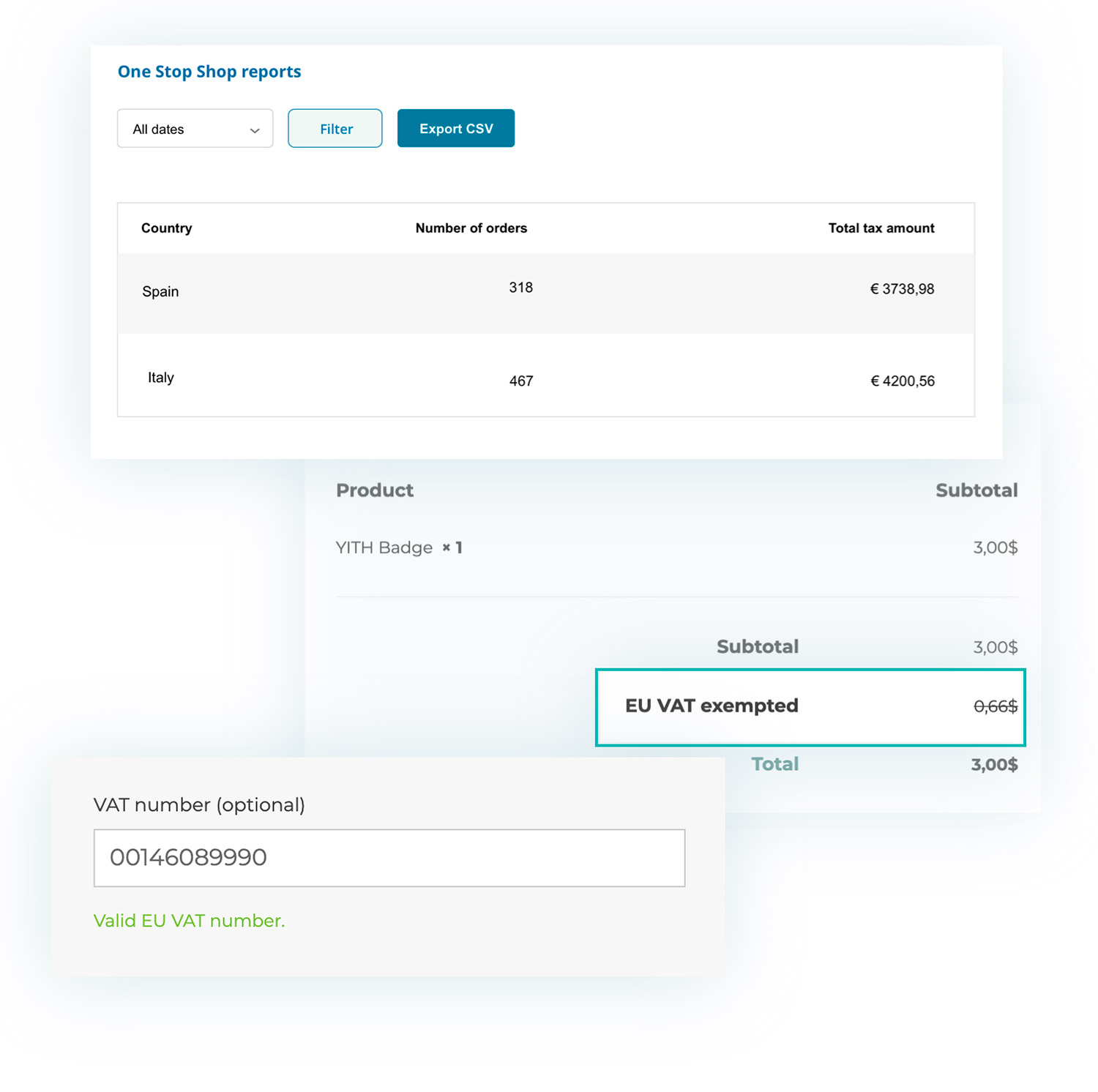

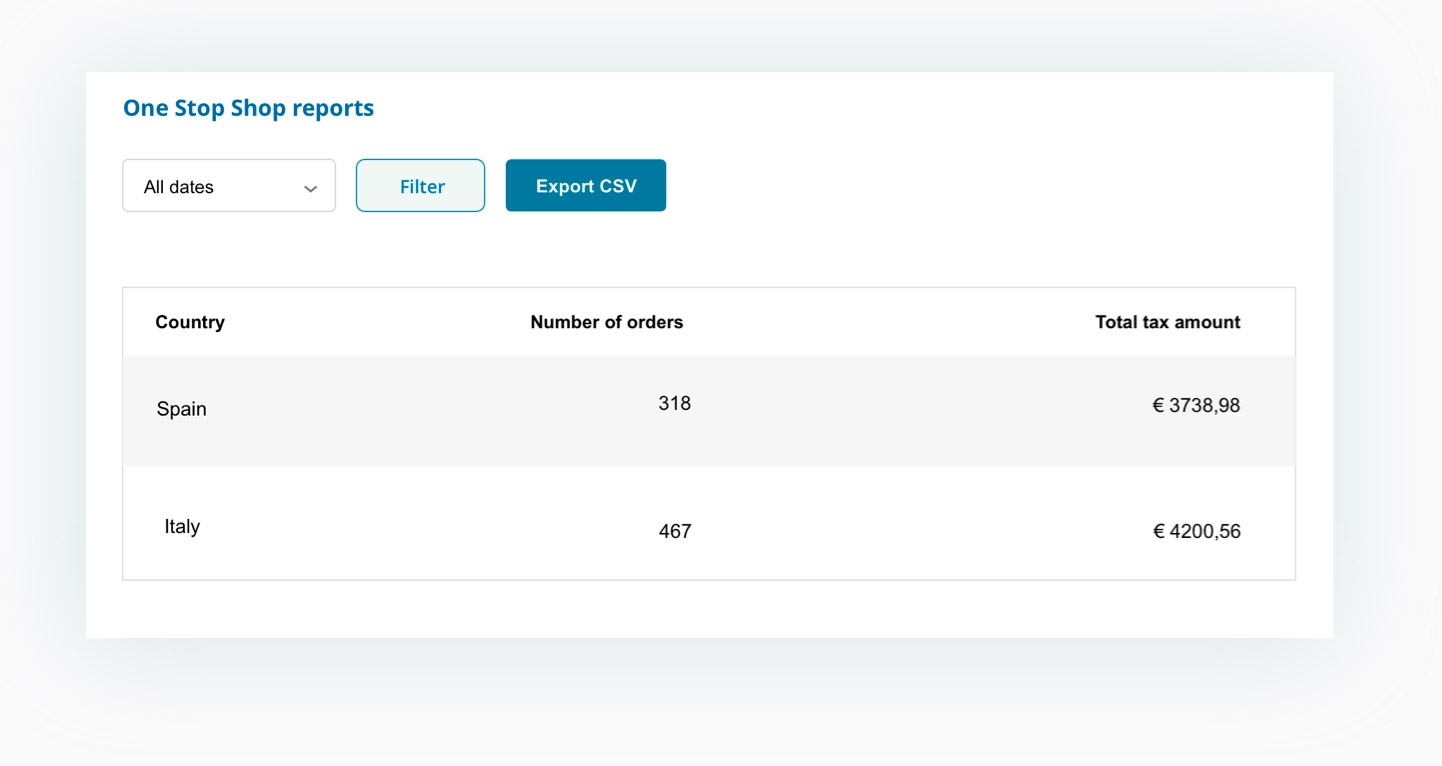

- Automatically create OSS reports that can be exported as CSV, to quickly update your records with the local tax authorities about your sales;

- Enable the IOSS to avoid charging VAT to European customers for orders above 150€.

- Prevent orders from customers located in the EU.

Manage the EU VAT exemption for your B2B customers and add compliance with the new One Stop Shop procedure of the European Union.

A shop owner that sells products or services in the EU needs to know, and fulfil, the requirements of EU VAT laws: our plugin YITH WooCommerce EU VAT, OSS & IOSS helps you to geolocate and identify your European customer’s location and automatically apply the correct VAT rate for B2C orders.

If you sell B2B, this plugin allows you to show a field in the check-out page where businesses can validate VAT and be exempted from VAT at your store.

The plugin is also updated to help you handle the new One-Stop-Shop (OSS) procedure required for all online retailers managing EU sales from 1 July 2021. With this plugin, you can monitor the sales threshold (10.000 €) for B2C exports to other EU countries, generate tax reports (monthly, every 3 or 6 months, yearly, etc.) and export them as CSV to easily notify your local tax authorities about your sales.

YITH WooCommerce EU VAT, OSS & IOSS Show and customize the VAT field at checkout

Choose whether to require VAT or not during the checkout and how to customize texts.The VAT field can be set as optional or required. If the user doesn’t insert a valid VAT, the purchase process can’t be completed.<br /> The check on VAT validity is made automatically and in real-time: the plugin validates the VAT number using the process of the official method of the European Commission, checking for the presence of the VAT number in the Intrastat records

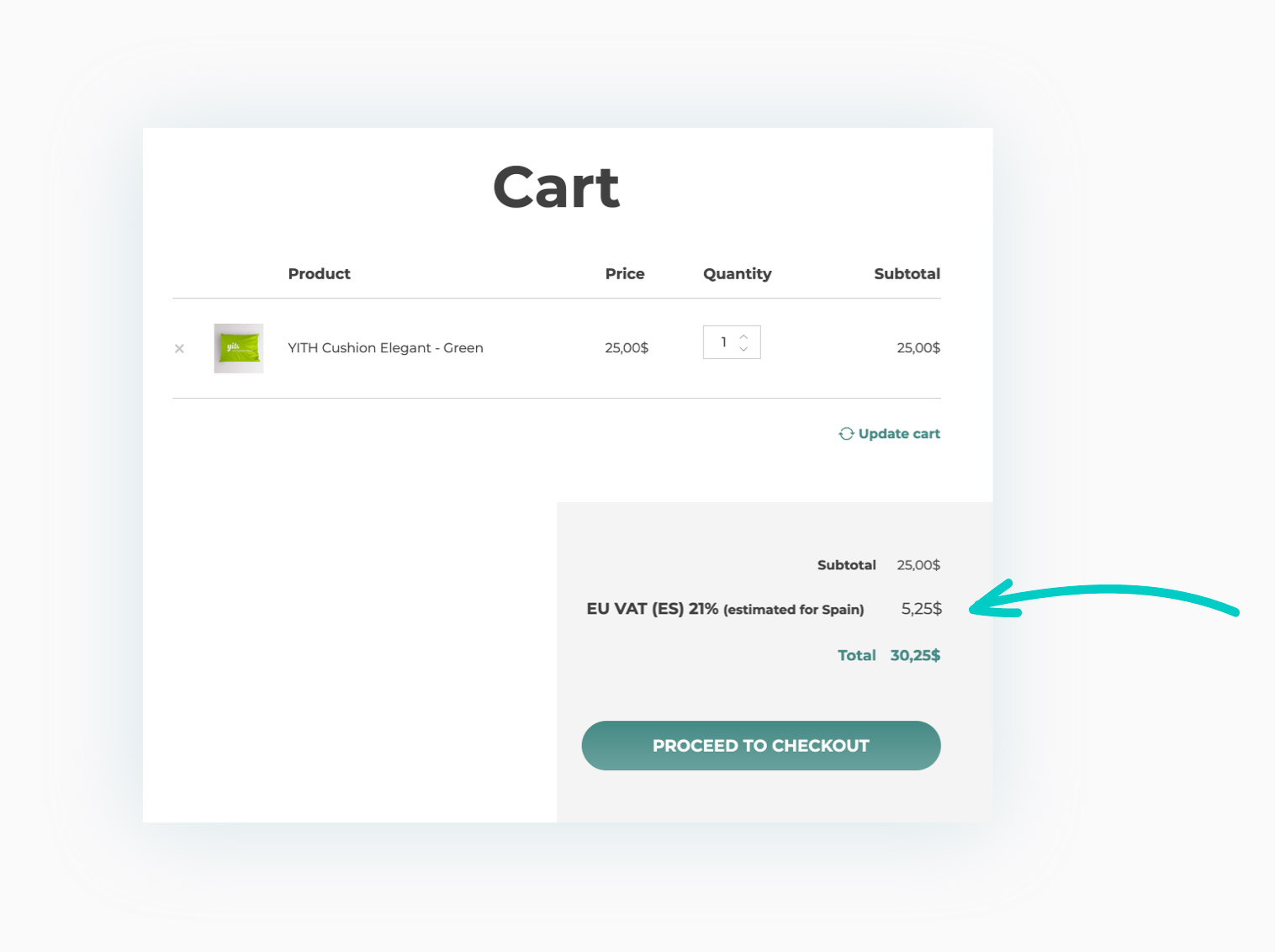

Geolocate users to show the correct VAT according to their countries

The plugin automatically geolocates users who access your shop to show them, on the Cart and Checkout pages, the correct tax based on their country

Import all the European taxes with one click

Save time and efforts: the plugin allows importing all the European taxes in just one click and choosing the countries to enable the VAT exemption

Manage VAT exemption for B2B European Customers

Companies from European countries you have enabled for the VAT exemption can insert their VAT in the checkout page and, after validating the field, won’t pay the TAX for the order

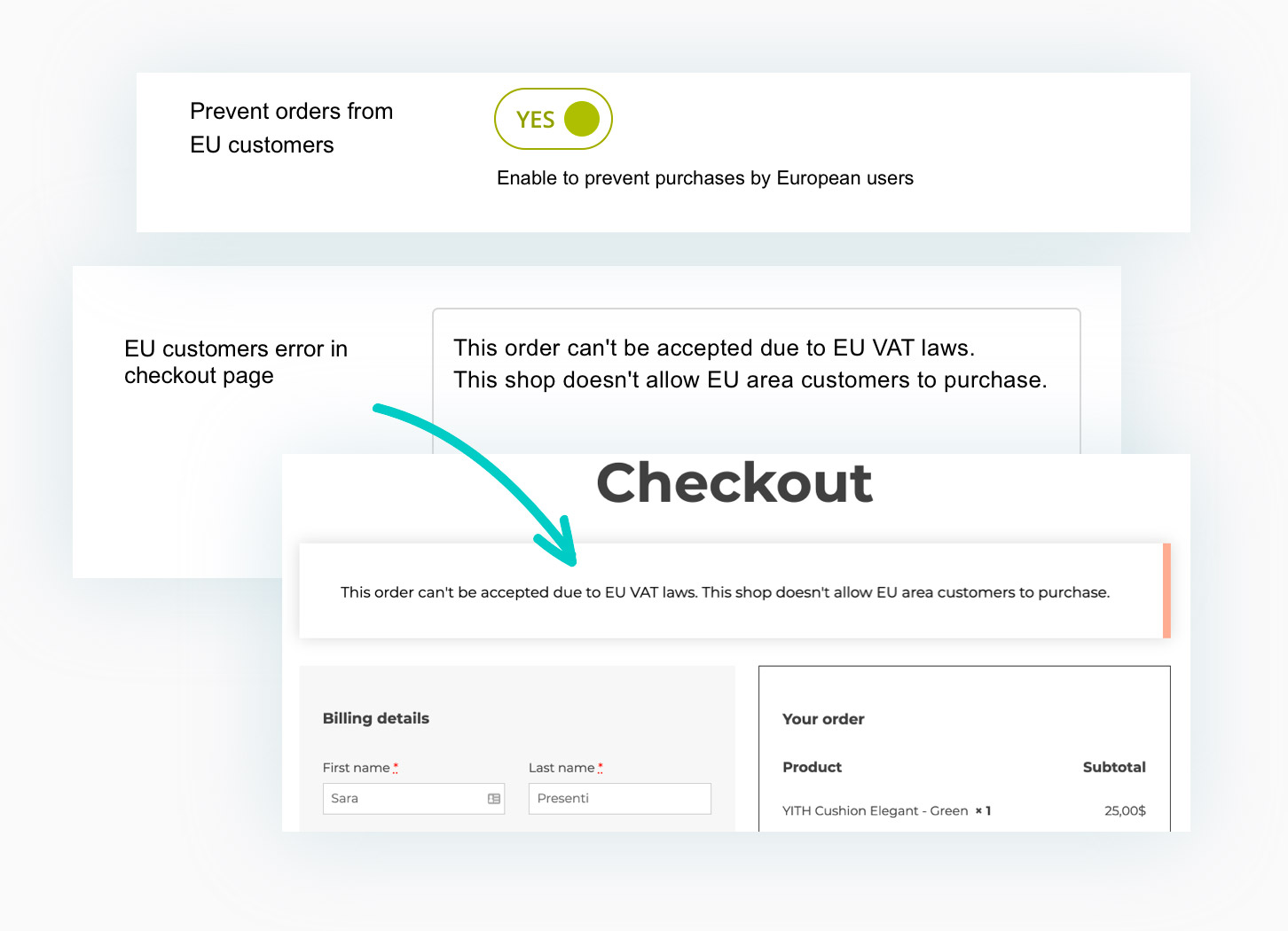

YITH WooCommerce EU VAT, OSS & IOSS Prevent orders from EU customers

Do you want to allow only customers outside the EU to buy from your shop? With just one click, you can prevent all users from EU countries from placing orders in your shop and show them a notice on the Checkout page

Ask address confirmation if IP and billing address don’t match

If the geolocalization of the IP address detects a missed match between the localized country and the one manually inserted in the billing address, the system will show a warning to the user who will be asked to confirm the country

Enable the One-Stop-Shop procedure and easily monitor the 10.000€ threshold

With just one click, you can enable the new One-Stop-Shop (OSS) regime, required for all online retailers that manage EU sales from 1 July 2021. With this procedure, if your EU cross-border sales stay under 10.000€/year, you can apply your country’s VAT; otherwise, you must apply the local VAT of the buyer’s country

Generate tax reports (monthly, every 3 or 6 months, yearly, etc.) and export them into a CSV

Enabling the OSS procedure, the plugin will automatically create reports that can be exported into a CSV file to quickly update your records with the local tax authorities about your sales.

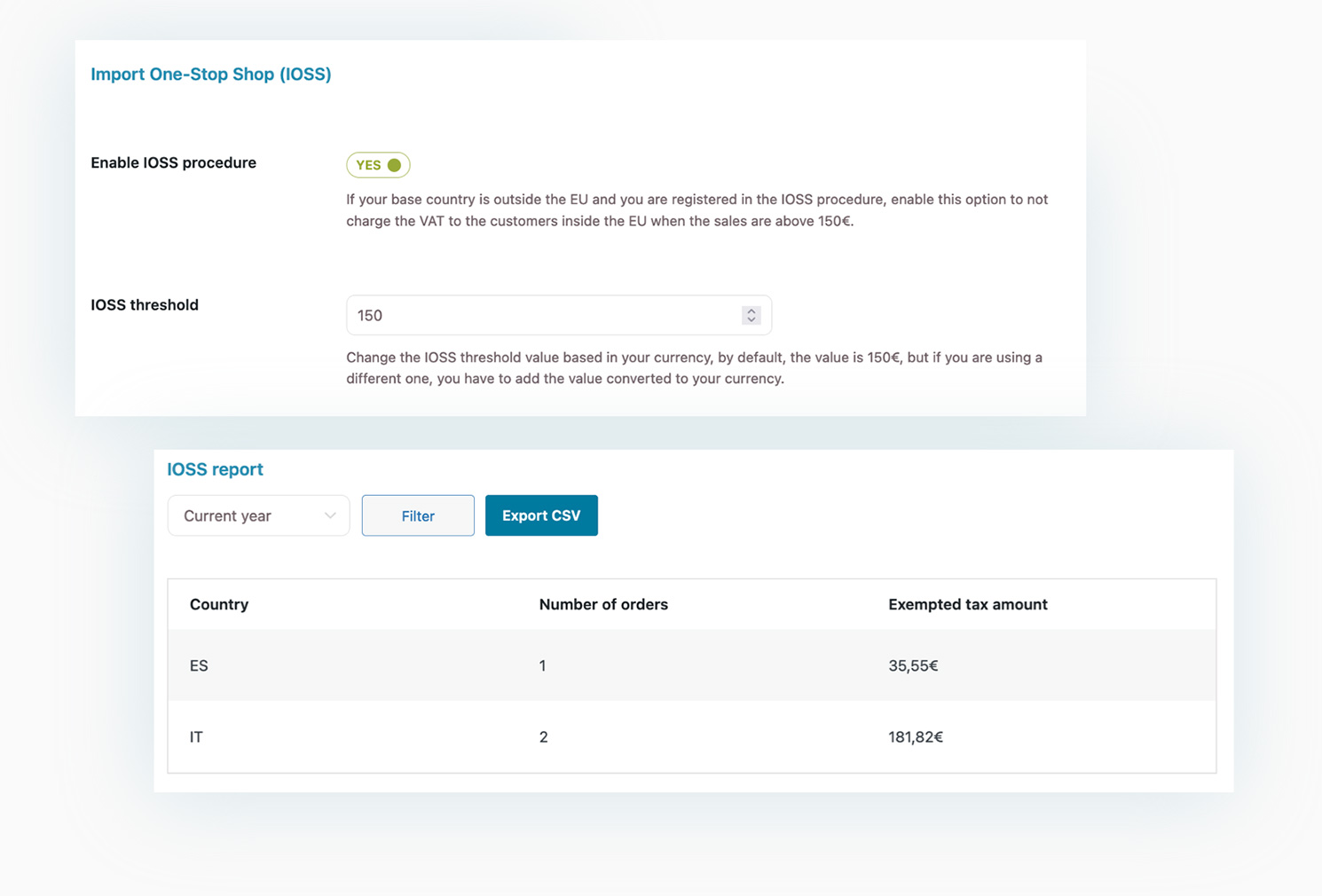

Enable the IOSS procedure and not charge VAT to EU customers when orders are above 150€

By enabling the IOSS procedure, if your base country is outside the EU and your shop is registered in the OSS regime you can avoid charging VAT to EU customers when their orders are above the value of 150€. In the plugin you will also find an IOSS reports section.

Get YITH WooCommerce EU VAT, OSS & IOSS now

> This product is intended for testing purposes only. To respect the original developer, we still recommend you to purchase the original product through the official sales site.

> 100% Clean Files & Free From Viruses & Free From Malware

> Unlimited Use

> Instant Download

$ 85.30 Original price was: $ 85.30.$ 3.49Current price is: $ 3.49.

OryMai

- Version: 2.31.0

- Last Update: March 6, 2024

| Compatible With | WooCommerce |

| Software Version | WordPress |

User Reviews

There are no reviews yet.